What effect is the Corona Virus having to the Spanish Property Market?

13 April, 2020

Like every aspect of our lives, the Spanish housing market will not be immune from COVID-19, but, in times of crisis, there are riskier places to keep your money than in bricks and mortar on the Costa del Sol.

The short-term market prospects for Spanish residential Real Estate look set for an extended period of uncertainty, while Spain and our neighbours in Europe focus their efforts and attention on containing the spread of the coronavirus pandemic. There are good reasons, however, to be confident demand for property on the Costa del Sol will rebound quickly and the market will make a solid recovery.

There has been an immediate stagnation in property sales, as notaries around the country have been advised to postpone the signature of all deeds while the state of emergency is in force, except for limited ‘urgent’ cases.

In contrast to the financial meltdown of 2008 (see my previous News Blog May 2019), this is very different. During that crisis, a number of banks, businesses and even individuals suffered the consequences (and, some would argue, consequences provoked by ill-informed choices of greedy financial institutions), whereas now most nations worldwide acknowledge the pandemic as a natural disaster that effects everyone. In principle, at least, Governments are committed to ensuring that societies and economies do not fail whatever it takes.

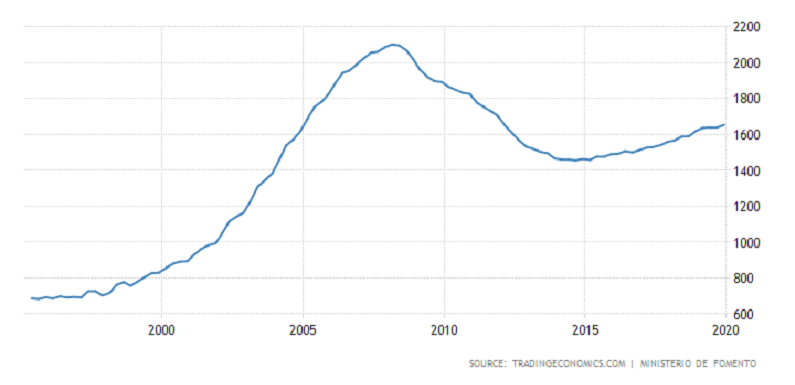

Moreover, in the 2008 crisis, Spain, and particularly the Costa del Sol, suffered the bursting of a bubble that had been forming for several years, with record levels of construction and credit in the form of highly leveraged mortgages. This is certainly not the case now, the market is not vulnerable as it was in 2008, new construction represents a much smaller share of the overall property market and banks have been cautious with lending.

For these reasons, in the medium term, the market for residential property in southern Spain, particularly for holiday homes and primary residences in the coastal areas, such as Estepona, Marbella, Benahavís and Sotogrande is not at threat of a drastic market correction. Of course there will be some unfortunate people who for personal reasons will be motivated to sell, but in general what will most likely happen is that, as things eventually begin to normalise, things will pick up again, albeit at first very slowly.

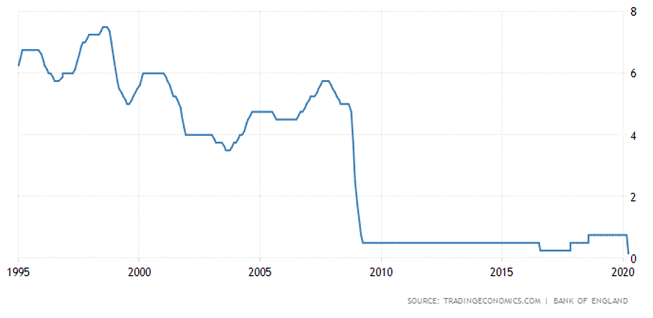

Compared to shares and bonds and especially interest rates (see below), which have posted record losses in recent weeks as the coronavirus epidemic has evolved, property is a tangible asset that can be used or can provide a return, even in a worst-case scenario, homes can be rented out, generating income for the present and accruing value for the future. Investing in property, whether it’s a main residence, second home or part of a portfolio, buys you something that exists and, irrespective of whether the market rises or falls, is a solid shelter for savings, especially over time. There’s a good reason it’s called Real Estate.

In the longer term, as the COVID-19 pandemic is bringing sharply into focus, life can be all too short. As I said in the May 2019 News, my wife and I bought our first property in Spain in 1995, we have seen the effects of the Crash in 2008 and we are now… following Brexit, see sterling gradually start to rise, a trend that I see no reason not to continue once life returns to level.

Spain will remain a great place to live and spend time for those lucky enough to own property here from all over Europe and around the world.

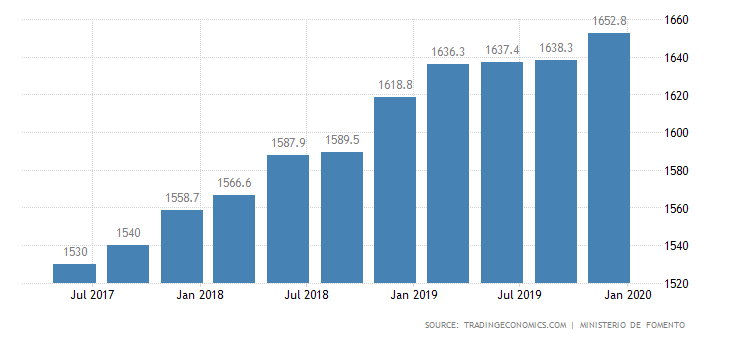

Below you will see the Spanish Property Index over a 20yr. and 3 yr. period into 2020.

Spanish Property Market Prices Euros/m2 20yr period

UK Interest Rates 1995 - 2020

Spanish Property Prices Euros per m2 Jan 2017 – Jan 2020

Tel +34 952927833 or email info@andalucianproperties.info

Back to blog