UPDATE: The Effect the Corona Virus is having to Spanish Property 2020 and…

28 October, 2020

Will the Property market in Spain rise?

The top predictions for the Spanish housing market in 2020 coronavirus (Covid-19) updated. Only data and graphs from official resources.

Spanish Property Market forecast for 2020 - 2021

UPDATE: Spanish property up due to the coronavirus (Covid-19)?

Firstly let me wish you All Well and hope this News item finds you in good health and spirit – these are difficult times for us all.

The Spanish property market has fallen to a standstill situation, as have the rest of the economies in other European countries, although it is expected to resume some activity towards the end of 2020, as the coronavirus crisis follows its natural course and a possible Vaccine is introduced.

The recovery will be due to domestic demand by Spanish nationals and the holiday property market by European citizens.

Regarding domestic demand, the APCE (Association of Promoters and Constructors in Spain) has already put forward a demand to the Government, together with other incentives, for the reduction of VAT on newly built property from an average 10% in most areas to 4%.

This could be one of the extraordinary measures that are now being implemented by the Spanish Government; to prevent all new housing promotions suffer the consequences of a long term crisis.

VAT (IVA) is applied to the property so the reduction would benefit all buyers, regardless of their nationality.

The general optimistic belief between promoters is that Covid-19 effects on the newly built property market would only be a delay in launching new promotions, but they don´t foresee significant reductions on the price.

The foreign holiday property market might be subject to high and low fluctuations as the crisis progresses during this year, once the movement restrictions are lifted.

Buyers and Sellers who are being kept on hold now, by the complete shut-down of the economy will want to exchange contracts as quickly as possible next year in case of a possible return of this Corona virus.

Investors with substantial cash amounts, who are already suffering losses in other financial investments, will quickly move to the property market as the safest place to keep money during times of economic uncertainty.

Bargain hunters are expecting to find special reductions on prices in some areas, as new properties add up to the ones already for sale prior to the coronavirus crisis, creating an excessive offer and the subsequent discounts.

Is the Spanish property market improving in 2020?

The Spanish property market started growing steadily in 2016 and, with the exception of last August and September (2019) slight falls, the general outlook was that market values would maintain the level reached up to now, with slight variations between 1 and 2 % in 2020.

Assuming that interest rates remain low for the time being and there is a lack of alternatives to make a return, the flow of money that goes towards the property market will remain high. This would normally ensure stabilization of Spanish house prices in 2020.

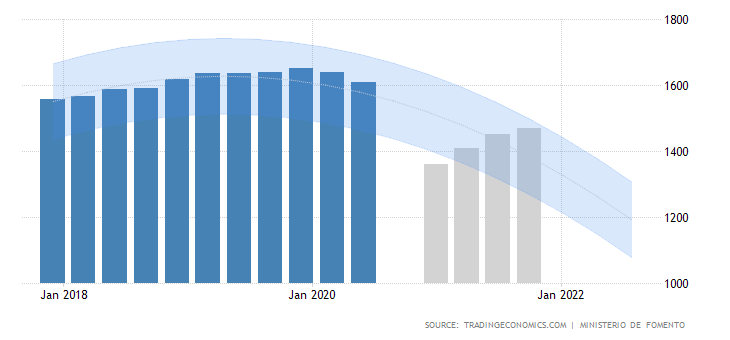

A good indicator of the evolution of the property market in Spain can be seen in the data showing the price per square meter. This data can be used to forecast and predict the path of the Spanish housing market. As the graph below shows, the growth continued steadily into 2020, until of course Covid took effect.

Housing Index in Spain is expected to be 1320.00 EUR/SQ. METRE by the end of this quarter, according to Trading Economics global macro models and analysts’ expectations. Looking forward, it is estimated Housing Index in Spain to stand at 1450.00 in 12 months’ time. In the long-term, the Spain House Prices is projected to trend around 1490.00 EUR/SQ. METRE in 2021 and 1650.00 EUR/SQ. METRE in 2022, according to the Econometric models.

Is the Spanish economy improving in 2020?

According to the European Commission, the growth prediction for the Spanish economy in 2020 “was” 1.9%, however that has fallen to -9.2% for 2020 but is expected to rise +6.8% 2021 (www.spanisheconomy.com ) The unresolved political issues to be dealt with by a fragmented Parliament and the demands in Catalonia and the coronavirus (Covid-19) situation are factors that will influence the already weak global economy, in Europe and the rest of the world.

Are construction trends affecting the property market in Spain?

The construction sector is recovering after years of hardly any activity, building permits experiencing an increase of 9% in 2019 and new developments are attracting money from investors globally, especially Russia and China, who account for 60% of the Golden Visa applications, since it was introduced in 2013.

The construction sector in Spain seems to be moving once again.

The supply and demand issue in the Spanish Market

Both construction and sales are expected to keep moderate levels and maintain the price rises that have taken place over the last four years, which are still 35% lower than before the 2008 crash, and a good investment opportunity.

In the second half of the year, the negative trend in house prices is expected to increase. Typically, after a significant drop in sales, prices tend to adjust a few months later. On this occasion the decline in sales has been very sharp due to the lockdown measures restricting people's mobility. It is therefore to be expected that house prices will gradually react to the new environment.

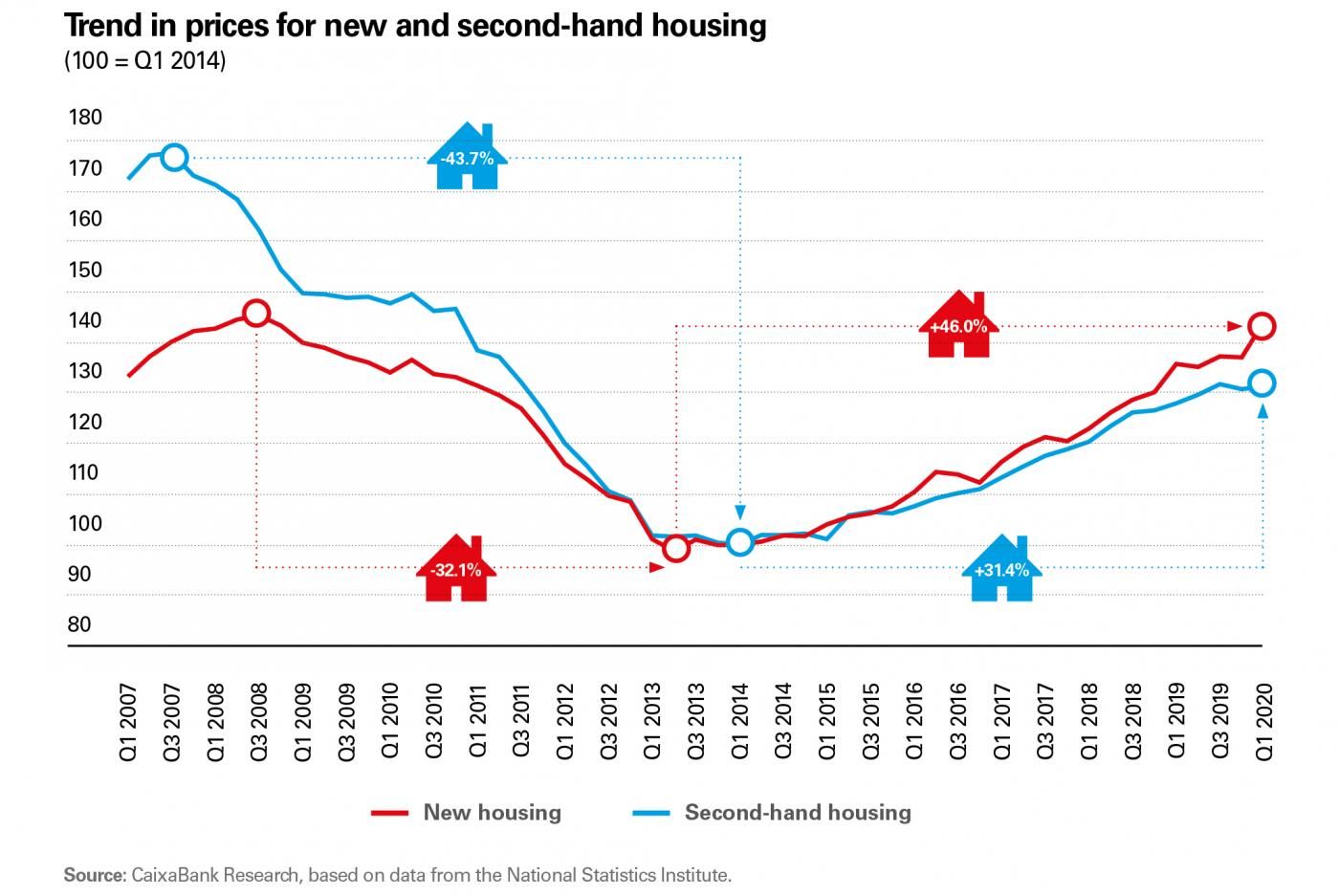

There is considerable uncertainty regarding the extent of the adjustment in house prices during this recession. Caixa Bank Research believe it very unlikely that prices will adjust as much as they did during the previous recessionary period and the price adjustment period is also likely to be significantly shorter.

The Real Estate sector is not the cause of the current shock nor has it accumulated imbalances that would require price adjustment mechanisms to be implemented to regulate and control the system. In particular, Real Estate was not overpriced in general before COVID-19.1

This has led to produce scenarios in which the adjustment in house prices will be more contained than in the last crisis. Specifically, it is predicted that house prices potentially could fall by between 6% and 9% (depending upon location) during the 2020-2021 period in Spain as a whole. While house prices would start to show positive growth rates in the second half of 2021.

We are seeing a “standstill” in the market, those who have had to sell, have by and large, already sold and new developments are not keen to lower their prices... but are offering incentives to Buyers for limited periods. I believe that little will change during 2020 but during 2021 there will be confidence coming back into the Market as travel restrictions are lifted due to improvements in Covid protection and immunization.

The Costa del Sol will remain a source of excellent Investments, an excellent Lifestyle and a desirable location in which to holiday and live.

tel. +34 952927833 or email info@andalucianproperties.info

Kind Regards

John Stephenson

Andalucian Properties

Back to blog